Did you know you can lodge your organisation BAS directly to ATO from your Xero organisation account? It is so easy!!

- No ATO Portal access.

- No paper.

- No Auskeys!

So Good!!

There are a few steps to set up and then you can lodge your BAS with the ATO from within Xero!

SET UP

There are a few things to do before you can start using this feature:

- Set up User Permissions

- Check your BAS Settings & make sure you are using the Simpler BAS

- Create the Xero to ATO Connection

Here are the detailed steps to perform this set up.

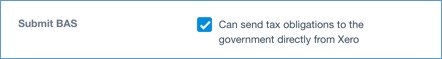

- Set Up User Permissions

New user Permission = Submit BAS

Users who are approved to lodge the BAS for an organisation must have this User Permission ticked.

To do this, someone with Manage User permissions, must go to:

- Organisation Settings

- Users

- Select the person who has BAS Lodgement permission in your organisation

- Tick in the Submit BAS Checkbox

- Click Update permissions

- Check your BAS Settings & make sure you are using the Simpler BAS in Xero

Check that your BAS settings are correct.

To do this:

- In the Accounting menu,

- select Advanced,

- then click Financial settings.

- Check that you BAS settings are correct for your organisation.

- Click Save if you made any changes.

- Then, click Go to Simpler BAS.

- Under Activity Statement Reporting Method, select Simpler BAS.

- Click Save & continue.

The ATO introduced the Simpler BAS reporting method in 2017. Using this method organisations report limited. Click here for some more information about Simpler BAS in Xero

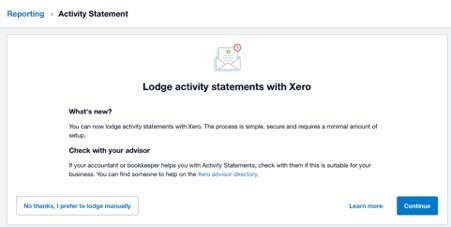

- Create the Xero to ATO Connection

To do this:

- In the Accounting menu,

- Select Reports

- Select Activity Statement in the Tax Section

- Then click Continue

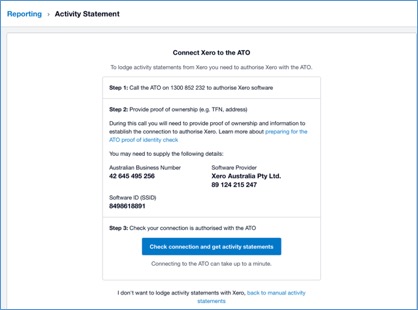

The Connect Xero to the ATO screen displays.

Read the screen – see below an example

Step 1: Call the ATO to authorise Xero Software.

Step 2: During this call you will need to provide Proof of record ownership*

This means that the ATO will need to confirm that you have the right to access information about the organisation you are authorising.

Step 3: provide the information on YOUR screen. That is:

- Your organisation ABN

- Software ID (SSID), and

- The Software Provider details

DO NOT GIVE THE ATO THE INFORMATION FROM THE SCREEN BELOW

– give the information from your own screen!

After you have finished your call with the ATO:

Step 4 – Check your connection is authorised with the ATO – click Check connection and get activity statements.

LODGE

Once you are set up, you can lodge your Activity Statement with the ATO from within Xero.

Make sure that you have reconciled all your bank accounts in Xero and checked your other account balances before you lodge your BAS.

- In the Accounting menu, select Reports.

- Under Tax, click Activity Statement.

The first time you run your activity statement, you’ll be asked whether you want to connect your organisation to the ATO. Click Continue to begin the setup process.

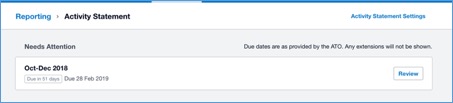

- Your outstanding activity statements are listed under Needs attention. For the reporting period you’re filing for, click Review.

Click Review

Xero will communicate with the ATO and fetch the Activity Statement information that is due

The completed Activity Form with the ATO information and the Xero information from your accounts is displayed

Click Transactions by tax rate to review the amounts against the various tax codes.

Scroll down and review the transactions sorted by Tax Rate

If you see anything strange click onto the transaction and review and adjust if required.

Click Back to the Summary Tab, when you are happy that the transactions and report is correct

- Export the report to PDF

- Click Lodge to ATO

- Tick Authorise the file

- Lodge

- Select the time it has taken

Create a Bill for payment with the exported PDF report attached.

Pay the ATO

Done!!! So easy!

Here are some links to some more information:

- Xero Blog about lodging your BAS directly from Xero

- https://central.xero.com/s/article/Lodge-activity-statements-with-Xero#Businesses

- ATO Link to Changing your Organisation Details for NFPs

*Here is some information about Proof of record ownership:

This is a two-step process:

- Step 1: We will ask for your name, tax file number (TFN) or Australian business number (ABN). This allows us to locate your tax record. We will then ask you to provide three items of proof that related to you as an individual that can be verified in our systems.

- Step 2: We will then establish your authority to access the information on the organisation’s record. Our records must show you are already an authorised contact of the organisation.”

“Items of proof include:

- address details

- financial institution account number

- details from a letter or notice generated by us (the ATO) and issued in the last five years, including, a notice of assessment sequence number, an activity statement document identification number (DIN), a correspondence reference number,

They will only disclose information and process an amendment to your registration over the phone, if you can meet both steps of the proof of record ownership requirements.

Trackbacks/Pingbacks