by Que Jones | Jun 19, 2019 | Churches, Payroll

Religious institutions may be eligible for FBT concessions for benefits they provide to religious practitioners. Churches have different names for these benefits. Some are: Minister’s Expense Allowances (MEAs) Non-Cash Benefits Minister’s Benefits To...

by Que Jones | Jun 19, 2019 | Auditing, Churches, Xero

Audit doesn’t have to be a year-end ordeal Maybe you have completed the audit for year end? Maybe you are rushing now to compete the church accounts and need just the final approval? This is the opportunity to consider the simpler and cheaper alternative to an...

by Que Jones | Jun 19, 2019 | Churches, Payroll

Many churches employ people on a casual basis for many roles and tasks. New legislation was recently passed that affect many modern awards that may affect church employees – clerical employees in particular. In summary A person engaged by a particular employer as a...

by Que Jones | Jun 19, 2019 | Churches, Payroll, Xero

Benkorp is getting ready for Single Touch Payroll (STP) STP is mandatory for all organisations employing staff from 1st July, 2019. It has been mandatory for employers with 20 or more employees from 1st July, 2018. Single Touch Payroll is a new ATO initiative. STP...

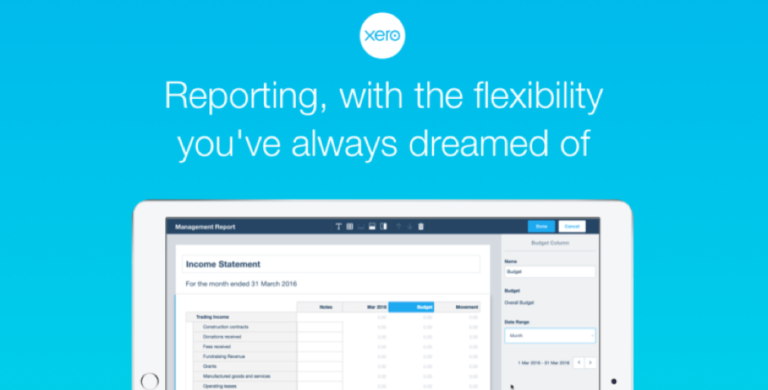

by Que Jones | Jun 19, 2019 | Churches, Xero

Xero continues to develop it’s new, flexible reporting platform. We at Benkorp, use these more and more. For Profit & Loss reports and Balance Sheets we can: Add many different columns for comparatives: Actual Data – eg last year, last month, Tracking ...

by Que Jones | Jun 19, 2019 | Churches, Xero

Single Touch Payroll (STP) mandatory for all employers from 1 July 19 A good clear explanation about STP STP works by sending tax and super information from your payroll or accounting software to the ATO as you run your payroll. When you start reporting: you will...