Religious institutions may be eligible for FBT concessions for benefits they provide to religious practitioners.

Churches have different names for these benefits. Some are:

-

- Minister’s Expense Allowances (MEAs)

- Non-Cash Benefits

- Minister’s Benefits

To receive these tax-free benefits, ATO conditions and rules must be adhered to.

One of these rules is that the benefit cannot be received as a cash-in-hand benefit. Cash benefits are taxable.

There are several ways to deal with these benefits. Three of the common ways these are:

- Reimbursement Method

-

- The church accrues the benefits/allowances

- The minister spends their own money

- The minister provides tax invoices and other documentation of expenditure

- This can include the payment towards a personal Credit Card balance

- The minister is reimbursed for this expenditure

- The reimbursed amount is deducted from the minister’s accrued benefit balance

2. Church pays the benefits on behalf of the minister

-

- The church accrues the benefits/allowances

- The minister submits bills/loans to be paid on the minister’s behalf

- The church pays the requested amounts

- The paid amount is deducted from the minister’s accrued benefit balance

3. Use of an ATO approved Debit Card*

-

- The church accrues the benefits/allowances

- All or part of the benefit is transferred to an ATO approved Debit Card

- The transferred amount is deducted from the minister’s accrued benefit balance

- The minister pays for expenses themselves using the ATO approved Debit Card

GST

-

- GST included in expenses paid for minister’s benefits is claimable from the ATO provided the appropriate Tax Invoices are available.

- Different denominations have rulings on who should receive the benefit of the GST – the church or the minister. This should be decided and documented by the church leadership.Bank Accounts

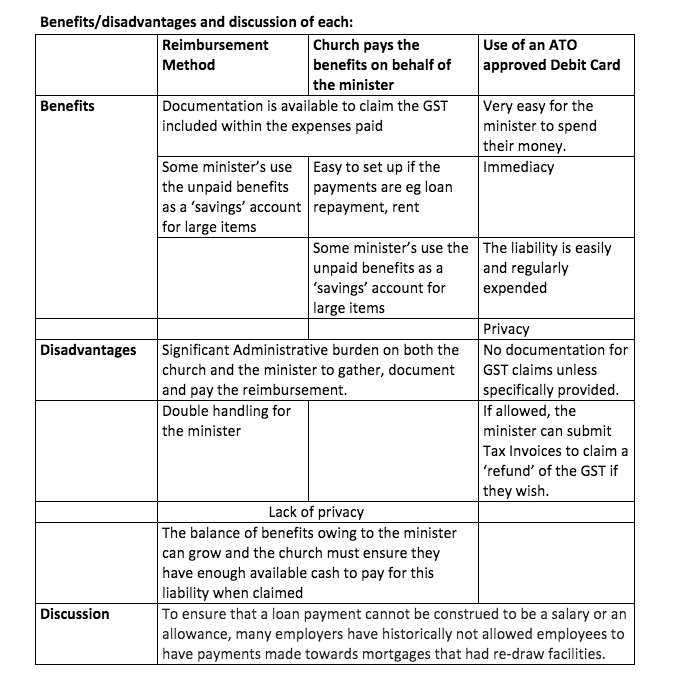

To ensure that the church has enough available cash to pay for these outstanding benefits, some churches create separate bank accounts for each minister’s benefits balances. Some churches have one separate bank account for all minister’s balances combined.Benefits/disadvantages and discussion of each:

2 examples of ATO Approved Debit Cards for NFP Salary Sacrifice tax free benefits:

-

- Community Banking Sector Debit MasterCard https://www.benkorp.com/debit-card-benefits/

- Westpac Everyday Purchase Card: https://www.westpac.com.au/corporate-banking/transactional-banking/managing-your-payables/salary-packaging-card/

ATO links about Fringe Benefits Tax Exemption for Religious Institutions

-

- https://www.ato.gov.au/Non-profit/Your-workers/Your-obligations-to-workers-and-independent-contractors/Fringe-benefits-tax/FBT-concessions/FBT-concessions-for-religious-institutions/

- https://www.ato.gov.au/law/view/document?DocID=TXR/TR9217/NAT/ATO/00001

We hope you have found this discussion helpful in deciding how to deal with the payments of your minister’s benefits.

Please contact us if you would like to discuss the financial management of your church or NFP at [email protected] or 1300 138 627

© Benkorp Management Services Pty Ltd 2019

Trackbacks/Pingbacks