The 2022 Federal Budget made some changes to the superannuation that are relevant to small-medium Churches and Not for Profit organisations.

1. Superannuation Guarantee (SG) contribution for low-income earners

The $450 monthly earnings threshold for superannuation contributions will be removed on 1 July 2022. Under the change, employers will be required to pay the superannuation guarantee on the wages of employees’ earning less than $450 per month. This change does not affect employees under 18 years old who are working less than 30 hours per week.

2. Superannuation Guarantee (SG) contribution rate increase to 10.5%

The 2022 Federal Budget has maintained the projected increase in SG to 12%.

The current SG contribution rate is at 10%. From 1 July 2022, this rate will increase to 10.5%. This will increase progressively to 12% by July 2025.

| Period | Super Guarantee Charge Rate |

| 1 July 2021 to 30 June 2022 | 10% |

| 1 July 2022 to 30 June 2023 | 10.5% |

| 1 July 2023 to 30 June 2024 | 11% |

| 1 July 2024 to 30 June 2025 | 11.5% |

| 1 July 2024 to 30 June 2025 | 12% |

3. Abolishing the work test for retirees

The work test will be abolished on 1 July 2022. Under the change, retirees aged between 67 and 74 can contribute to their superannuation without having to satisfy any work test, provided their superannuation member balance is less than $1.6 million, rising to $1.7 million in July 2022.

What is required in your accounting system?

Make sure that you check and ensure your payroll and accounting systems are updated for the upcoming changes for 1 July 2022. Edit your payroll information/setup AFTER the final payroll for YE 30.6.2022.

For Xero users

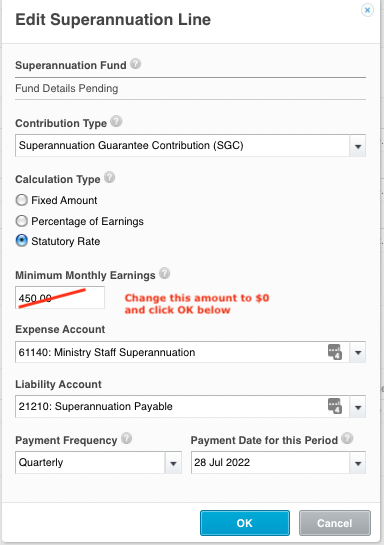

1. To update the minimum Monthly earnings before superannuation is applied.

Open the Pay Template of each employee, click on the Superannuation Fund name and change the Minimum Monthly Earnings amount to $0.

NB you don’t need to make this adjustment for employees who are under 18 and work less than 30 hours per week.

2. Change the SG contribution rate to 10.5%

There are 2 ways to deal with this

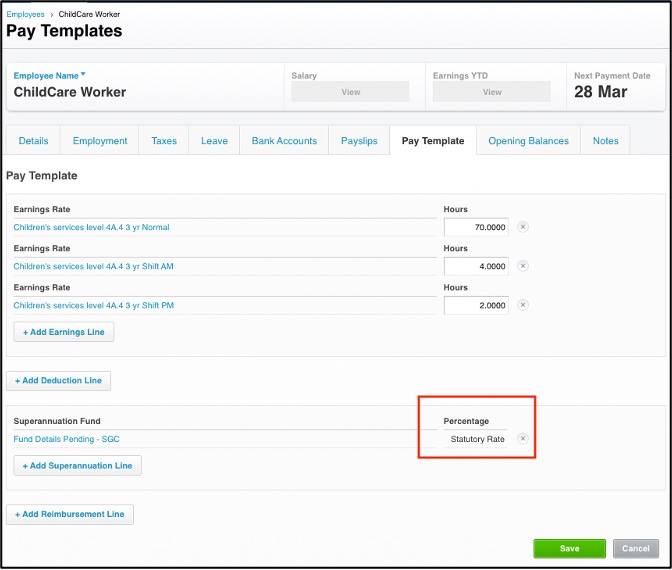

If your Superannuation Type is “Statutory Rate” – Do Nothing.

Xero will make the necessary changes.

To see if you are using the Statutory Rate, open the Pay Template of each employee.

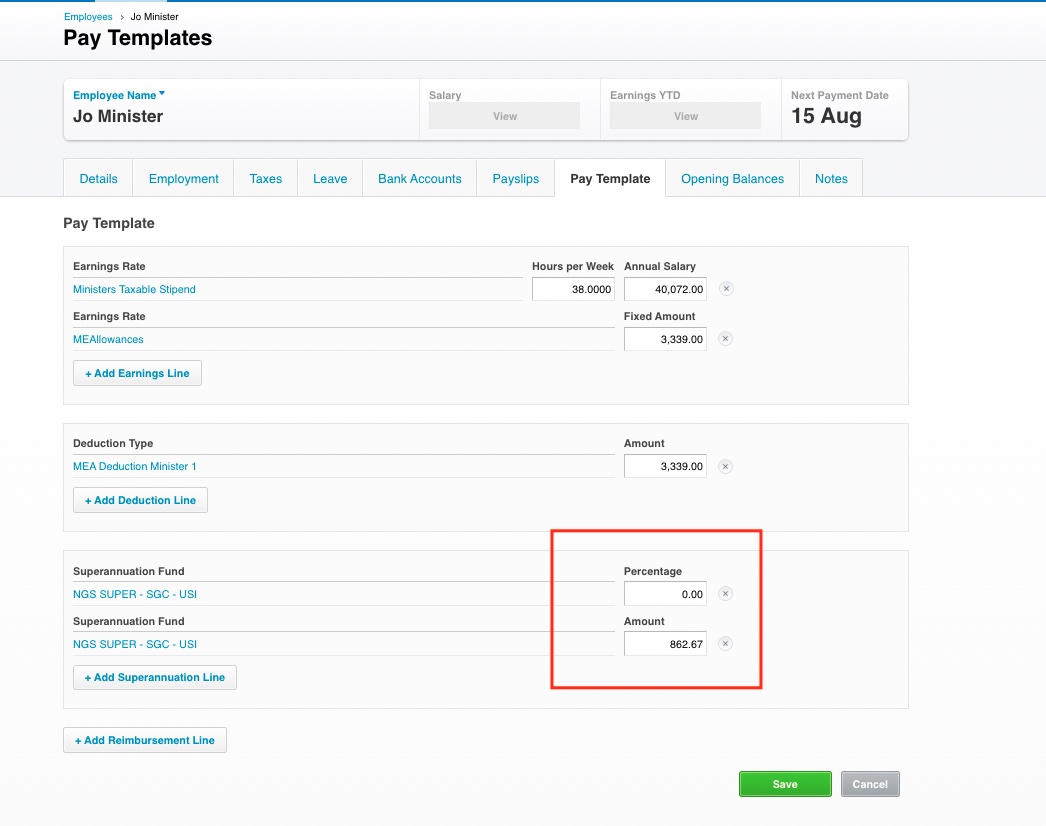

If your Superannuation Type is NOT “Statutory Rate”

You will need to manually calculate the new amount and make the changes.

You can see this on the Pay Template screen of each employee

To adjust:

Timing: These checks should be completed after your final June 2022 pay run and before you process your first pay run in July 2022.

Calculate the correct percentages or fixed amounts and enter on this screen.

If you require any assistance, please submit a request via this link: https://www.benkorp.com/assistance-services/