A couple of major stimulus packages ago the PAYG Cash Boost was announced by the Australian Government.

Please click here for the details of this.

In essence, eligible employers will receive credits allocated to their ATO Activity Account based on the filed March BAS with a minimum of $10,000 and maximum of $100,000.

There are some important things TO DO NOW-

Make sure that:

- You prepare & file the March 20 BAS with the ATO on or before the due date – 21st for monthly or 28th April for quarterly, and

- The ATO has your current financial institution details (your bank details) – so that it may refund any credit owing.

NOW: Please ask the “ATO contact person for your organisation” to check that the ATO has your organisation’s current bank account details. Contact us if you are having problems with this – we may be able to help.

How to account for the PAYG Cash Boost credit we recommend that you

- Calculate your expected PAYG Cash Boost, and

- Create the BAS Invoice or bill that includes the expected PAYG Cash Boost.

1. Calculate your expected PAYG Cash Boost

The best and easiest way to do this is to click here and use this PAYG Cash Boost Calculator to calculate your expected PAYG Cash Boost.

Some Examples:

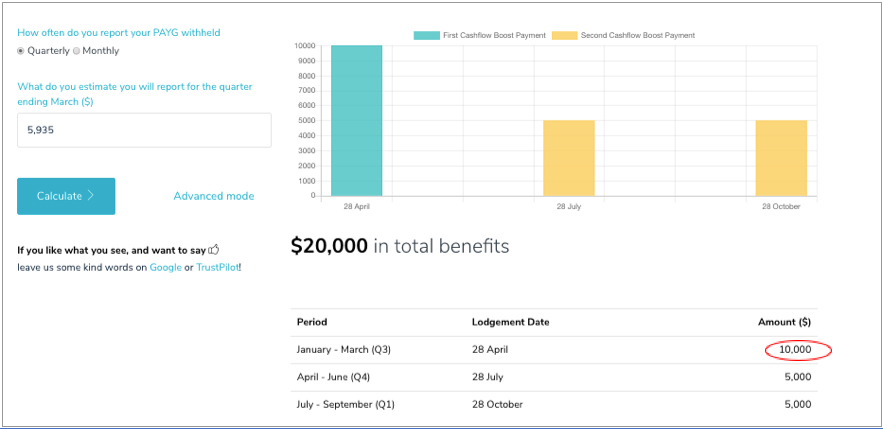

Example 1

If you lodge your Payroll details Quarterly with the ATO, click quarterly and enter your Jan-March 20 PAYG amount (this example is $5935) and click Calculate

In this example the expected PAYG Cash Boost credit to be received on 28 April is $10,000

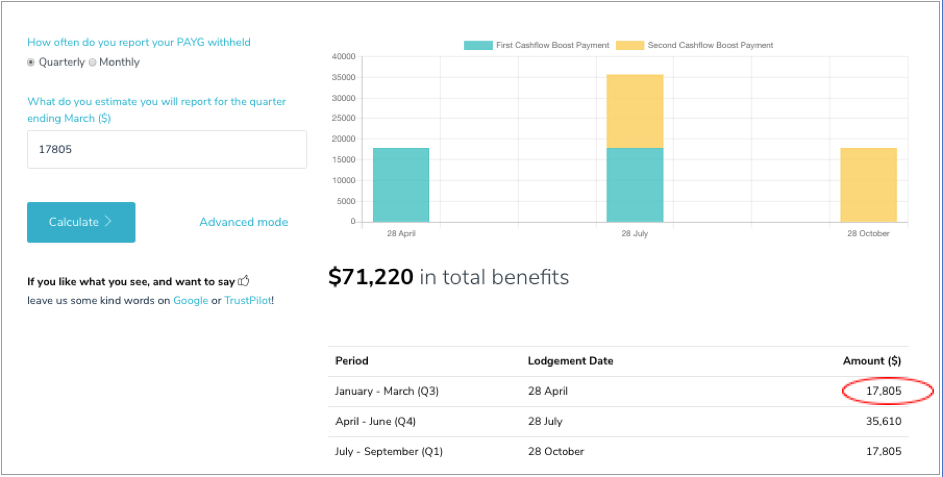

Example 2

If you lodge your Payroll details Quarterly with the ATO, click quarterly and enter your Jan-March 20 PAYG amount (this example is $ 17805) and click Calculate

In this example the expected PAYG Cash Boost credit to be received on 28 April is $17,805

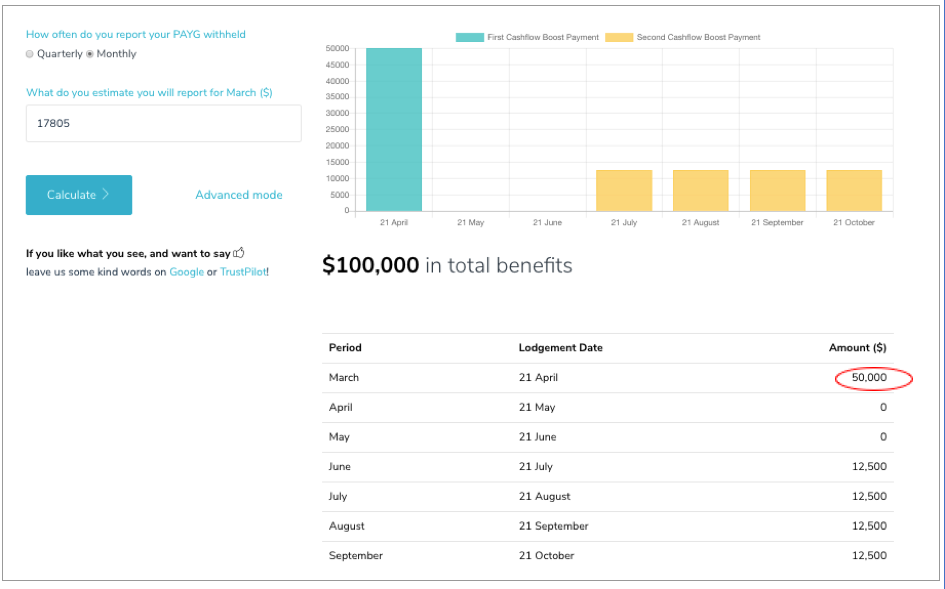

Example 3

If you lodge your Payroll details Monthly with the ATO, click Monthly and enter your March 20 PAYG amount (this example is $ 17805) and click Calculate

In this example the expected PAYG Cash Boost credit to be received on 28th April is $50,000

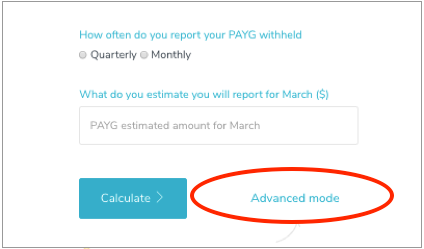

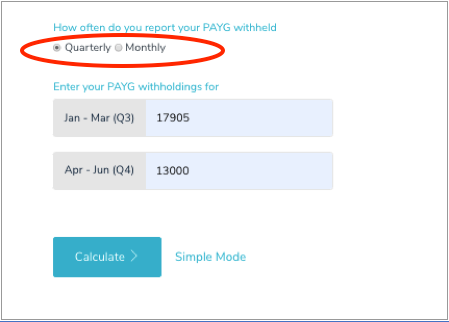

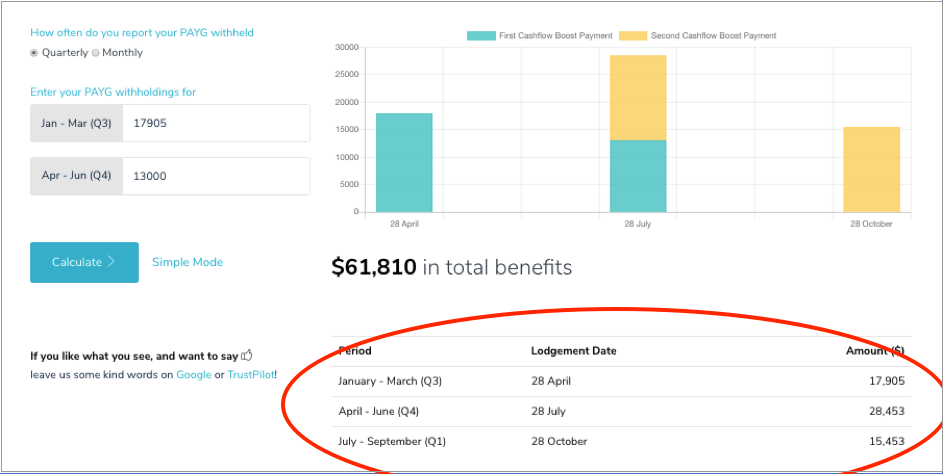

To calculate the PAYG Cash Boost credits for subsequent months, please click Advanced Mode

Select Quarterly or Monthly

Enter the correct PAYG amounts

and click Calculate

This calculator will display the credits you should receive and the timing of the credits

2. Create the BAS Invoice or bill that includes the expected PAYG Cash Boost

We always recommend that a BAS Invoice or Bill is created when you lodge the BAS for your organisation. You have all the information available at that time and do not need to go back and calculate the amounts again when the amounts appear on your bank statement.

When you create the bill or invoice always attach the supporting documents & reports as well as a copy of the actual BAS lodged.

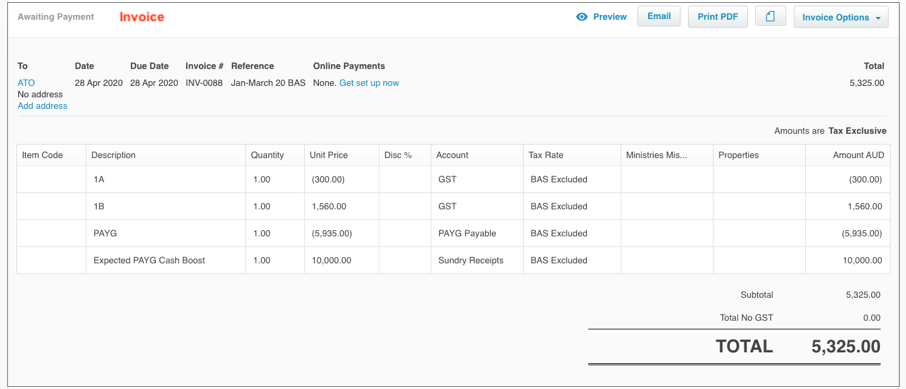

If the ATO owes you money – that is the total of your BAS less the PAYG Cash Boost – is negative, create an invoice in Xero and enter as follows:

Apply the refund of $5325 to the invoice when it appears in your bank account.

If the amount you expect does not appear in your bank account or the amount is different than your expectation, then check your calculations and/or contact your organisation ATO contact or BAS Agent to check why the difference. It is possible that your BAS Agent or ATO contact will need to request the refund if the refund does not come automatically.

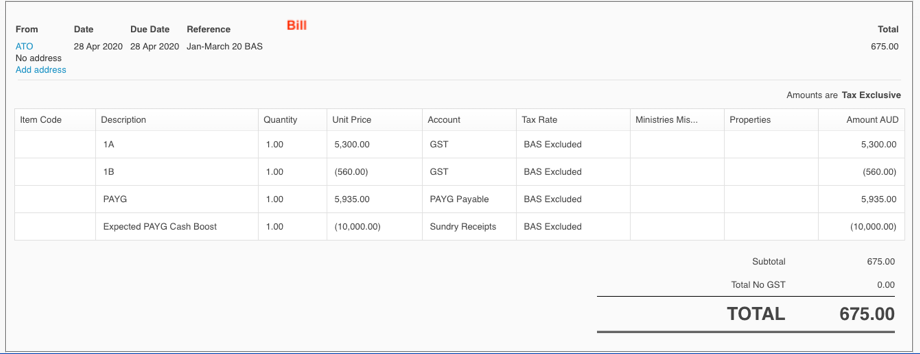

If you owe the ATO money – that is the total of your BAS less the PAYG Cash Boost – is positive, create a Bill in Xero and enter as follows:

Organise to pay the ATO $675

Also make sure your BAS Agent or ATO contact checks that the payment of $675 will pay out the amount owing to the ATO – as per your organisation’s Activity account with the ATO.

We hope you have found this helpful.

Please let us know if you have any questions or need help with any of the above.

Please note that this document is especially to inform small & medium not-for-profit organisations and particularly Australian Churches.

The information we provide may be helpful for businesses, but it is not created for business advice. We recommend that businesses receive advice from their BAS Agents or Tax Accountants.