From 1st July, 2019, all employers will need to submit payroll details to the ATO after each payrun. Many employers are already doing this and Ministers and other Religious Practitioners are included.

Religious Practitioners have special fringe benefits tax exemptions and people are concerned that the introduction of STP may affect their income tax.

Making sure that the Income Tax is calculated correctly, and Allowances are not reported on the Annual Payment summaries is not easy regardless of which payroll system is used.

From our investigations and discussions with churches already using STP we note that:

- Ministers Payroll must be set up properly in Xero. Please click here see our previous article about the way we recommend to set up Ministers Pays in Xero

- The Xero STP Finalisation report produces the number we expect – similar to the annual payment summaries

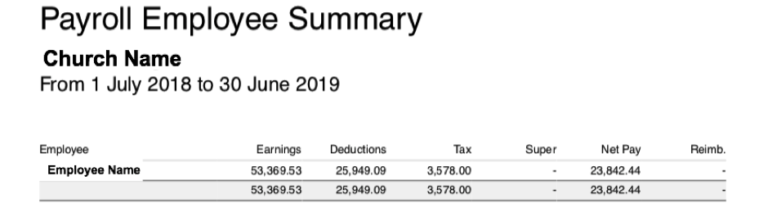

See the “reports” below produced from Xero

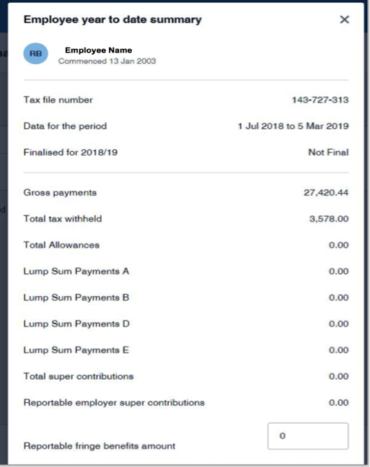

This can be displayed after STP has been activated in your Xero file.

To find this, Click on Payroll>Employees>End of Year reports>STP Finalisation, then click into the employee’s name to display the screen below.

In this example the Taxable earnings are usually calculated as Earning less Deduction = Gross Payments reported to the ATO.

That is $53,369.55 – $25,949.09 = $27,420.46

To check your own payroll:

-

- Check your minister’s payroll set up in Xero with our recommended set up

- Produce these two “reports” in Xero and compare as above

Please let us know if you have any issues or questions re this.

Please contact us if you would like to discuss the financial management of your church or NFP at [email protected] or 1300 138 627

© Benkorp Management Services Pty Ltd 2019